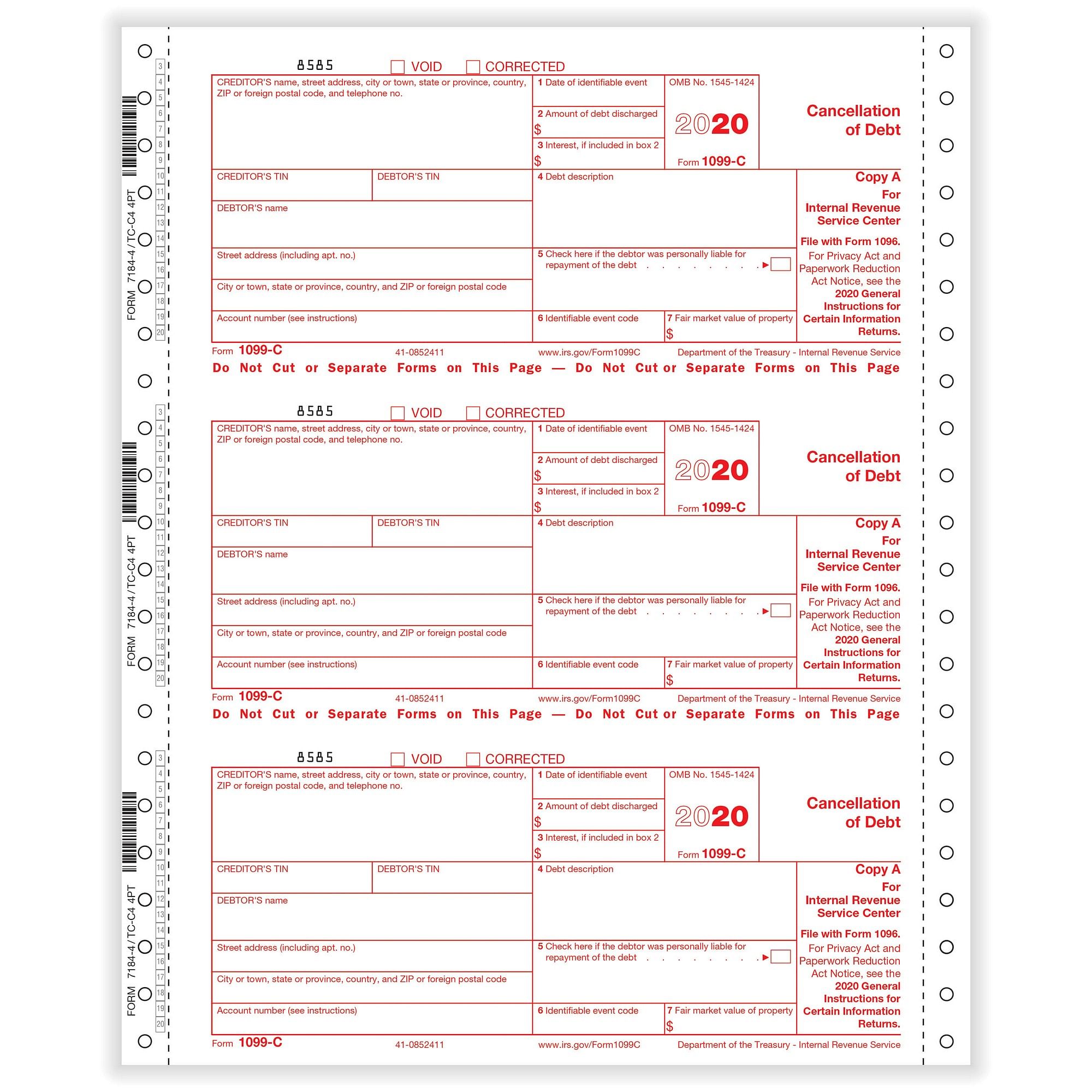

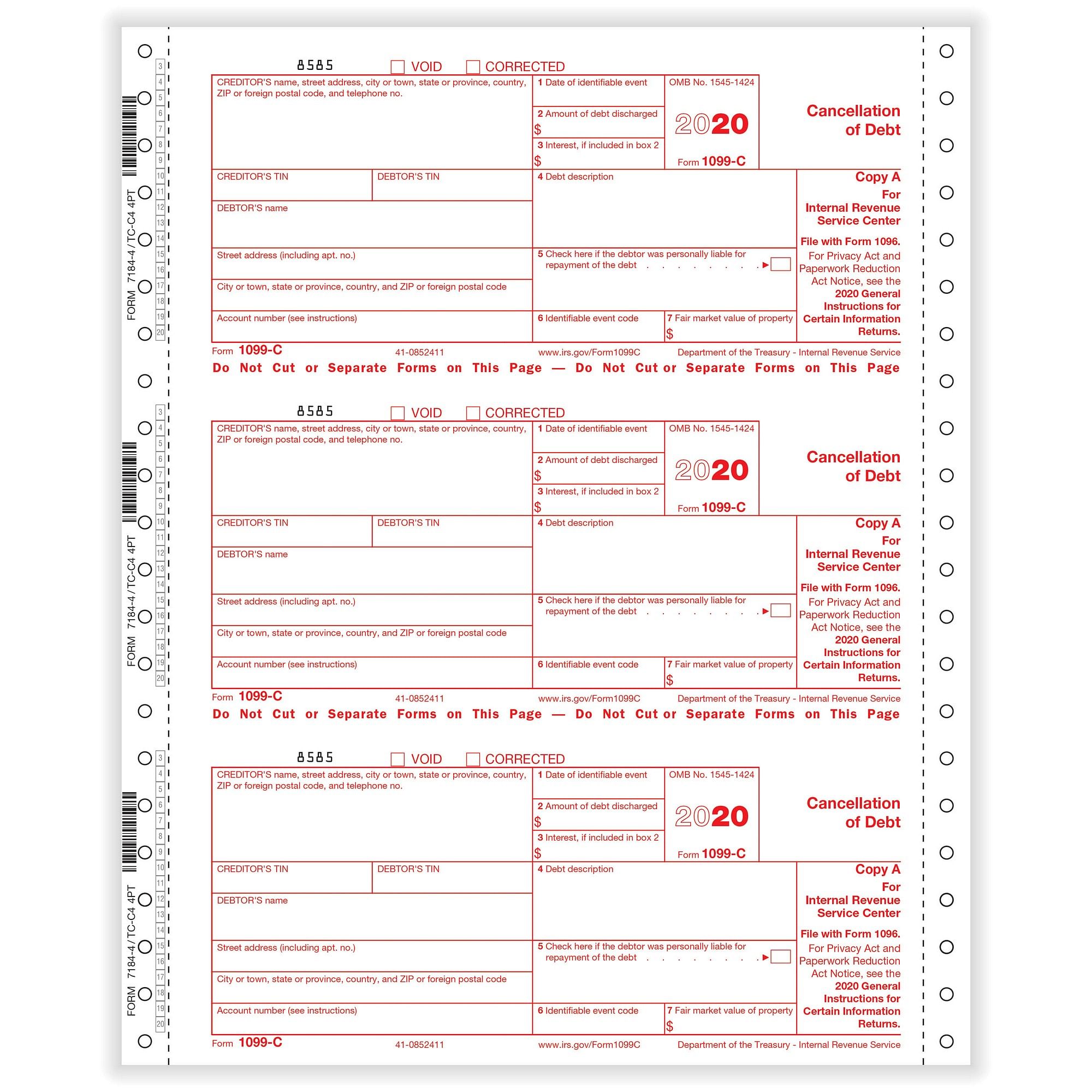

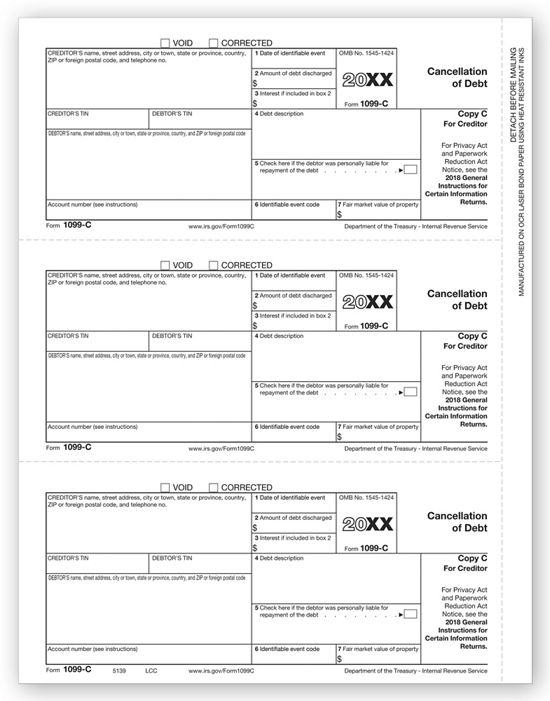

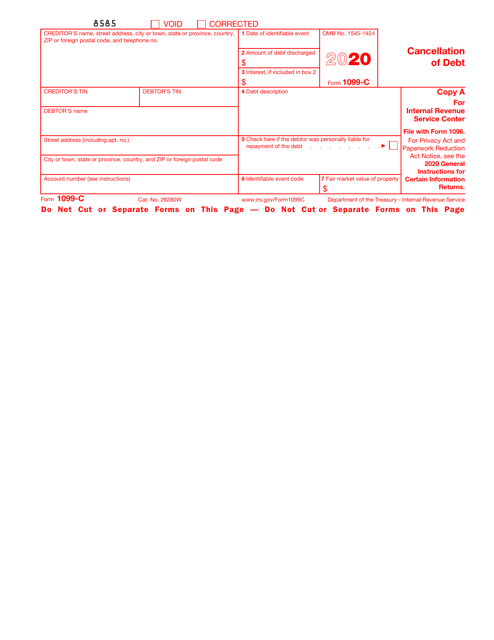

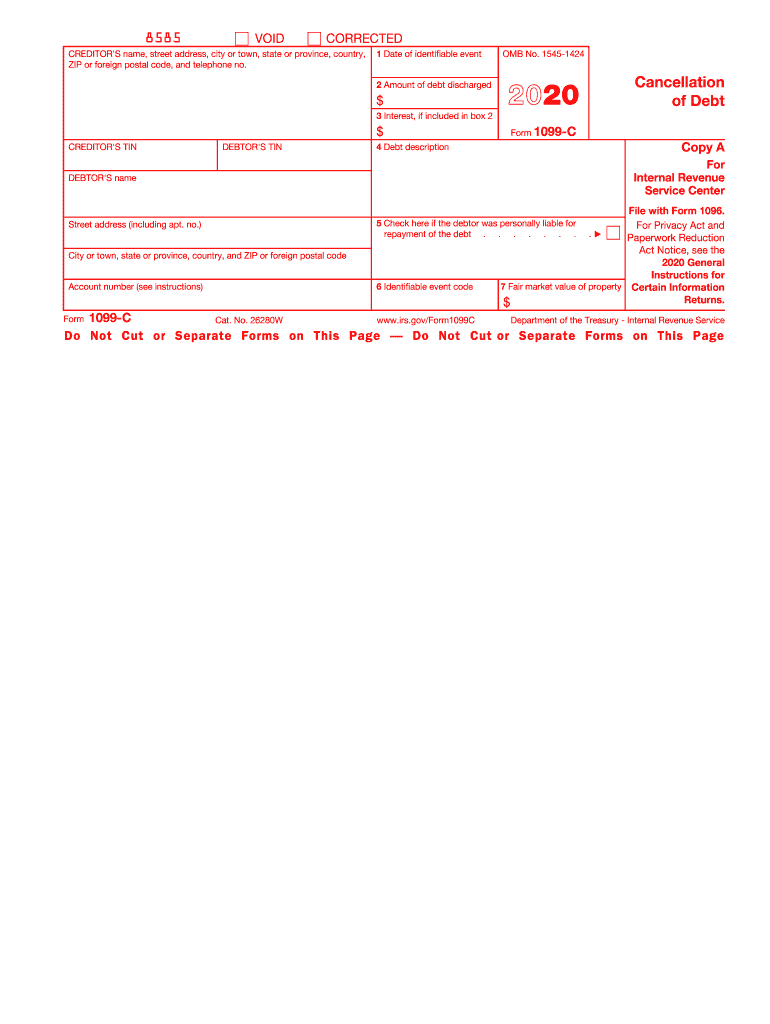

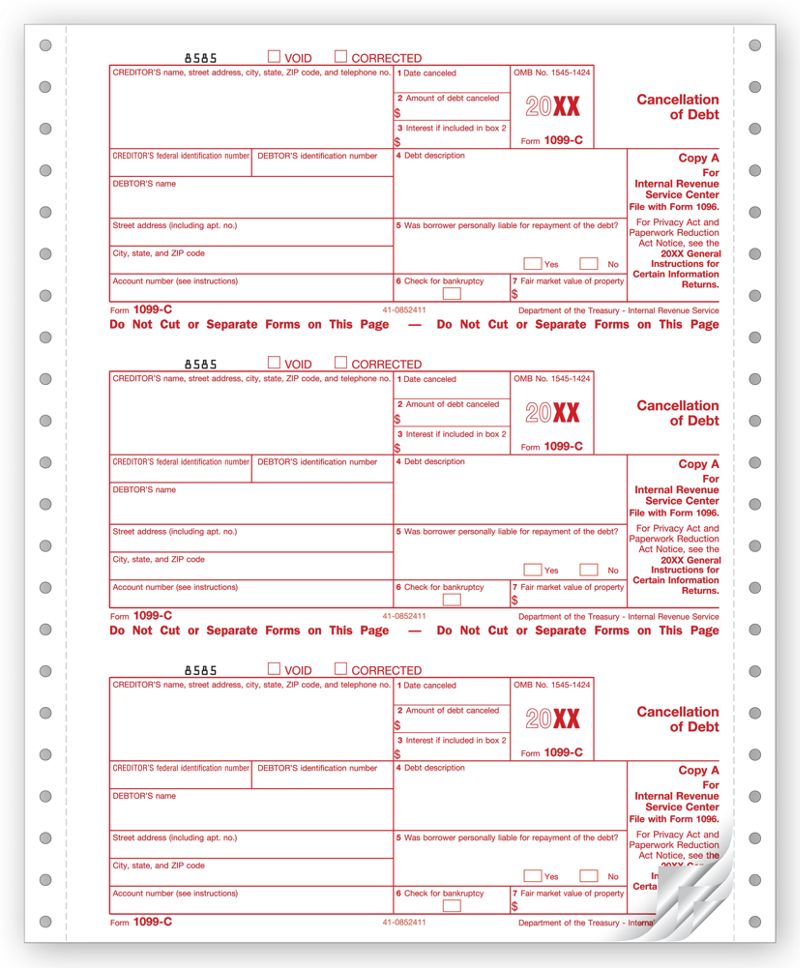

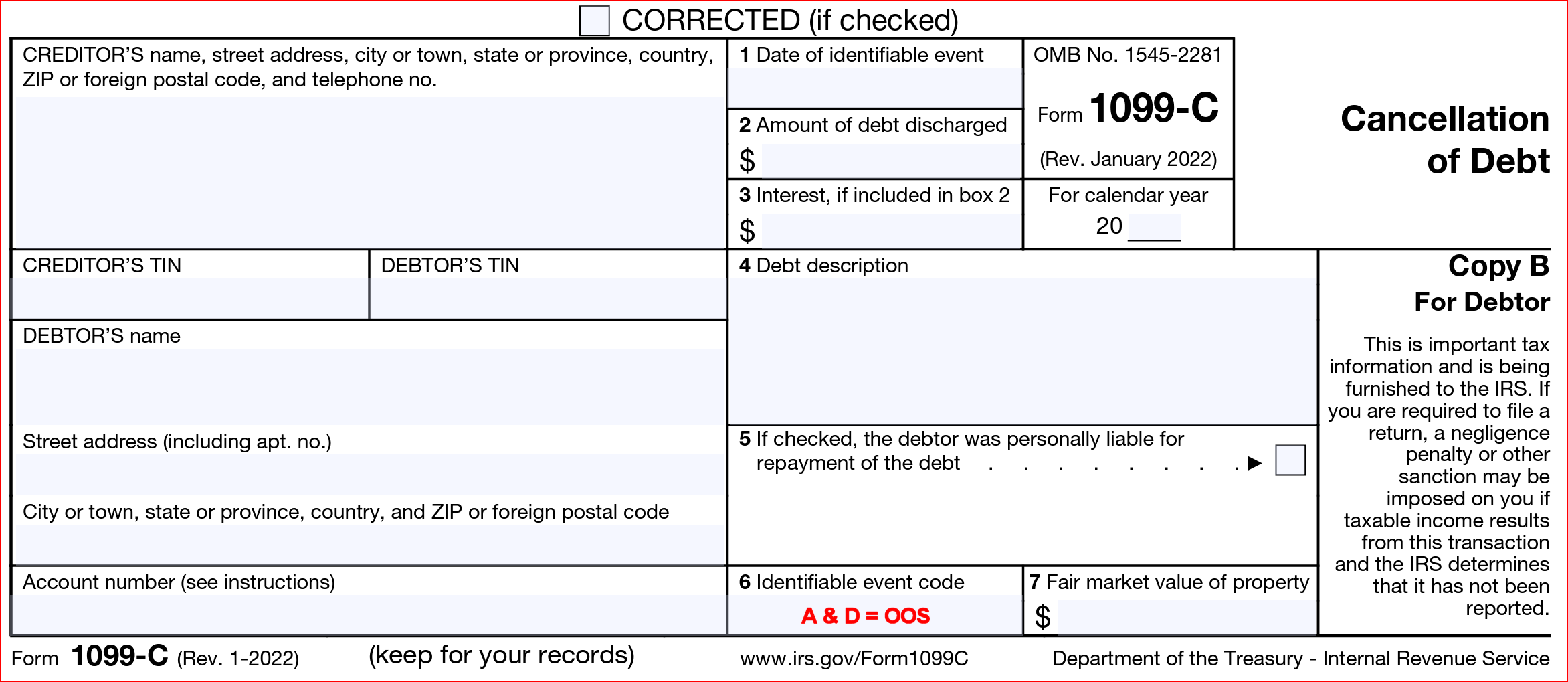

Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actually canceled Your lender can tell you this amount · Hit enter to search Help Online Help Keyboard Shortcuts Feed Builder What's newOfficial 1099C Forms This 3part carbonless form includes Creditor Copy A (federal, red scannable), and Copy C (file) and Debtor Copy B Your typewriter or pinfed printer will print all copies at the same time Don't forget envelopes!

1099 C Cancellation Of Debt 4 Part 1 Wide Carbonless 0 Forms Pack

How to complete a 1099-c form

How to complete a 1099-c form- · 1099C exceptions to taxing student loan forgiveness;A financial institution, the Federal Government, a credit union, RTC, FDIC, NCUA, a military department, the US Postal Service, the Postal Rate

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Click Add Form 1099C to create a new copy of the form or click Edit to review a form already created Continue with the interview process to enter all of the appropriate information Based on your entries, the system will compute any canceled debt income Under certain circumstances you may exclude the amount of canceled debt from your gross income Click Yes · If this had been a real 1099C form for forgiven debt and you received it so many years later, May 21, Financial Freedom Can Student Loan Forbearance Help?File 1099C Online with Tax1099 for easy and secure eFile 1099C form How to file 1099C instructions & due date IRS authorized eFile service provider for form 1099C

113 – Dividends and Interests;About Form 1099C, Cancellation of Debt Internal Sep 23, — Information about Form 1099C, Cancellation of Debt (Info Copy Only) Learn more Form 1099C IRS Courseware Link & Learn Taxes Lenders or creditors are required to issue Form · Note that if the foreclosure includes a cancellation of debt, you will also receive Form 1099C All pages of Form 1099A are available on the IRS website Here's a quick rundown of Form

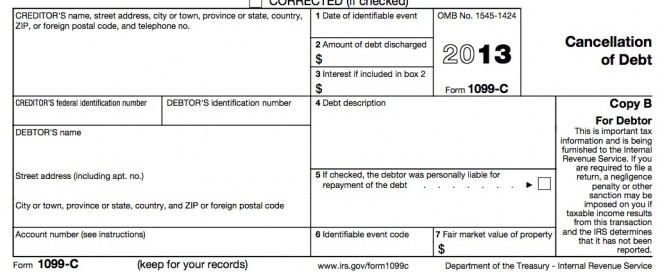

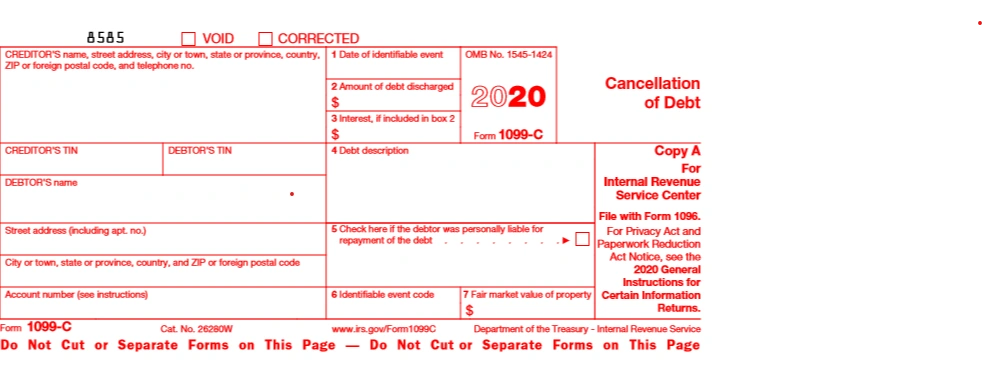

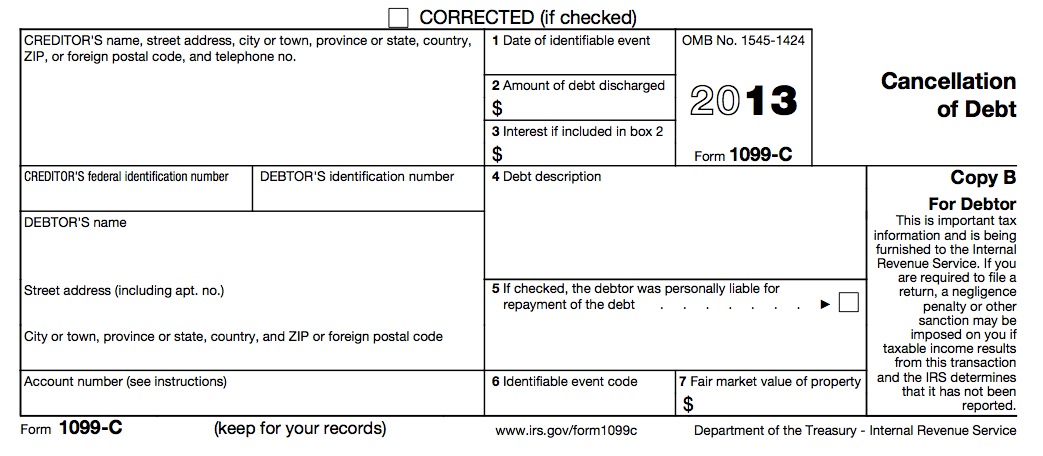

If you have a taxable debt of $600 or more that is canceled by the lender, that lender is required to file Form 1099C with the IRS The lender isTOP Forms to Compete and Sign;Form 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines that it has not been

1099 Int Form Copy C Payer Discount Tax Forms

Form 1099 Misc Miscellaneous Income Payer Copy C

· 19 1099 C Form – A 1099 Form is really a form of doc that can help you determine the earnings that you simply attained from numerous sources It is crucial to be aware that there are many various kinds of taxpayers who may be needed to finish a form of this character For instance, in the event you work as an independent contractor for somebody else, you'd have to total a form/08/19 · I'm administrator for the estate of a taxpayer who died in May 19 I just got word that a creditor will cancel an outstanding debt and issue an IRS Form 1099C later this year Question is, will this be taxable income for the decedent or forTo enter or review the information from Form 1099C Cancellation of Debt into the TaxAct ® program From within your TaxAct return (Online or Desktop), click FederalOn smaller devices, click in the upper lefthand corner, then click Federal;

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Form 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses theIf a Form 1099C Cancellation of Debt for canceled debt is issued to an S Corporation, the income inclusion (or exclusion) is applied at the corporate level If applicable, the corporation would then file Form 9 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 10 Basis Adjustment) with their tax return to report any tax attribute reductionsQty 25 49 $ 135 ea Qty 50 99 $ 096 ea Qty 100 299 $ 069 ea Qty 300 499 $ 050 ea Qty 500 999 $ 045 ea Qty 1,000

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

0 May 5, 21 How StudentsForm 1099 A Form 1099 C 1 A creditor required to issue a 1099 A when a borrower abandons the real property 1 The lender required to issue a 1099 C when the forgiven debt is greater than $600 2 1099 A is not a notice of forgiveness 2 1099 C is a notice to the IRS that the financial institution has forgiven the debt 3 According to theThe IRS requires that all income and deductible expenses are reported by businesses and individuals or penalties could apply Who needs to file 1099C?

Walk Through Filing Taxes As An Independent Contractor

How To Fill Out And Print 1099 Nec Forms

· I received a 1099C Cancellation of Debt formIt says that the date of the identifiable event was 12/23/, the amt of debt discharged was $, the debt description was "Consumer credit card", Box 5 said "Borrower was personally liable for repayment of debt, Box 6 shows Identifiable event code as "G" (Decision or policy to discontinue collection), State TN,Click Other Income in the Federal Quick Q&A Topics menu to expand, then click Cancellation of Debt (Form 1099C)If you have employees working for you, it is mandatory for you to file W2 This goes for all of the

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

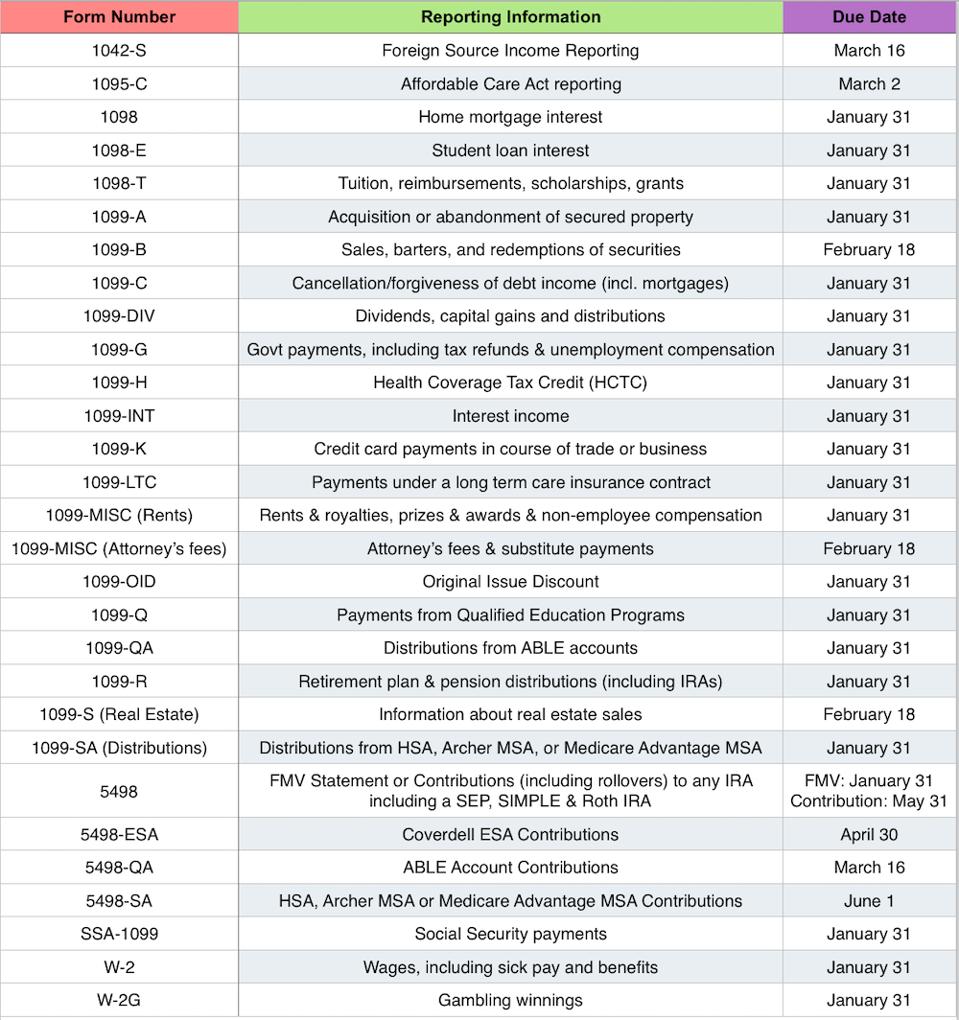

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21 · By sending the Form 1099C to the IRS, lenders can claim a deduction on their own returns as bad debt and lost income If you don't report a received Form 1099C, you can incur IRS penalties and interest, or the IRS might choose to audit you You can report a missed 1099C receipt even after you filed your return with a Form 1040X, Amended US Individual Tax Return112 – Debt Cancellation;

1096 Form 1099 Forms Taxuni

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

To find out if a 1099C has been filed, you canThe IRS 1099C form called "Cancellation of Debt," is used when a lender cancels or forgives a debt owed Because the person who owed the money no longer has to pay this debt, the IRS considers amounts over $600 on this form as taxable income The IRS requires the decedent's estate to pay taxes on the amount of the canceled debt reported with 1099C Lenders must file this form · In 19, she had one last credit card debt forgiven, and I received a 1099C From what I read on TurboTax, it said for me to download TurboTax Business to file a 1041 for the trust and include the 1099C info However, I am on TurboTax business right now and there are no 1099C forms Feel like I should just get a refund on the software and just have HR Block help me

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

· Form 1099C—Cancellation of Debt is the tax form that reports canceled debt which is taxable in most cases This includes the debt that has been canceled, discharged, or forgiven The IRS sees pretty much any debt that has been lifted off of your shoulders as taxable incomeWhat if you can't pay your tax bill? · What is a 1099C form?

Form 99 C Archives Optima Tax Relief

1099 C Tax Form Copy C State Laser W 2taxforms Com

· For example, Code G on Form 1099C is for the "Decision or policy to discontinue collection" According to IRS Publication 4681, "Code G is used to identify cancellation of debt as a result of a decision or a defined policy of the creditor to discontinue collection activity and cancel the debt How do I know if my 1099 C was issued? · If you had any debts canceled or expect to receive a 1099C, you may want to work with a professional tax service to file your taxes What Is a 1099C Cancellation of Debt?In most situations, if you receive a Form 1099C from a lender after negotiating a debt cancellation with them, you'll have to report the amount on that form to the Internal Revenue Service as taxable income Certain exceptions do apply The federal tax filing deadline for individuals has been extended to May 17, 21

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

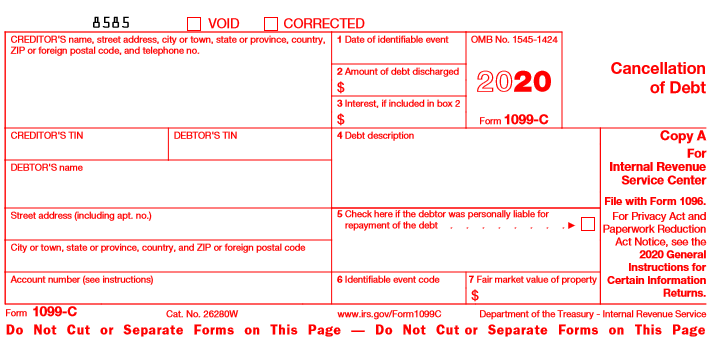

19 Form 1099C Attention Copy A of this form is provided for informational purposes only Copy A appears in red, similar to the official IRS form The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not Do not print and file copy A downloaded from this website;C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aForm 1099C comprised of 7 Boxes

What Is Form 1099 Nec For Nonemployee Compensation

1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling Human Resources Forms

· 1099 Form Deborah Ann Last Updated February 17, 0 2 minutes read Contents 1 Freelancers and Independent Contractors 11 Other Uses of Form 1099 – Government Payments 111 – Retirement Account;Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1099C, steer clear of blunders along with furnish it · Form 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines that it has not been

1099 Misc Form Fillable Printable Download Free Instructions

1099 C Tax Form Copy B Laser W 2taxforms Com

· The number of debt cancellation forms sent to taxpayers – and the Internal Revenue Service – shot up after the recession It fell for the first time in 16 According to the update of IRS Office of Research Publication 6961, more than 39 million 1099C forms will be filed covering the tax yearWithin a 1040 return, there is not a specific IRS 1099C input form to fill in Instead, depending how the cancellation of debt is to be treated, there are a few options you have in order to get this to flow correctly to your return Method 1 To have the amounts from the IRS 1099C flow to the 1040 line 21 as other incomeA 1099C is a form used to report various types of income It's one of several 1099 forms that are used to report income that isn't reported on W2 forms

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 G Form Copy C State Zbp Forms

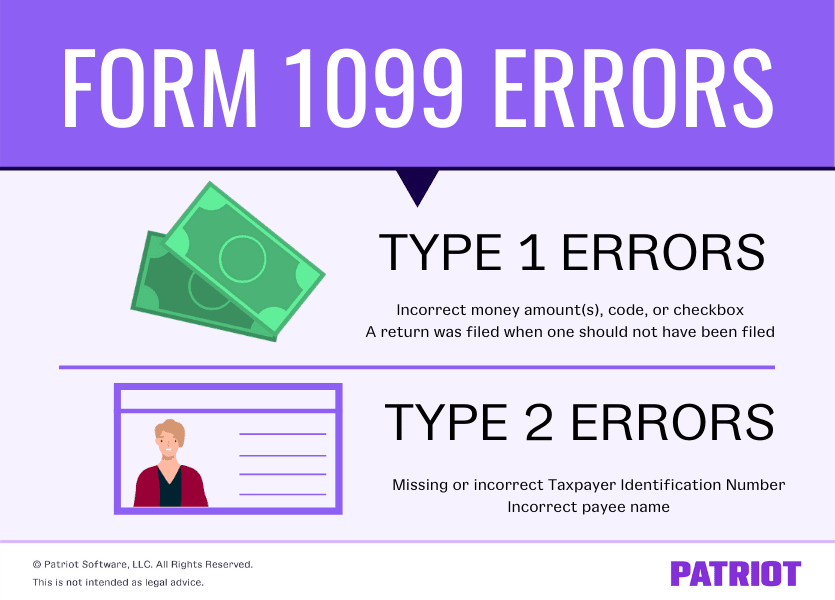

· But even if they processed the payment in January of the 1099C should be issued for the tax year and not 21, even though you would receive it in 21 Form 1099 Correction Process Call the IRS and have an IRS representative initiate a Form 1099 complaint The IRS will fill out form 4598, "Form W2, 1098, or 1099 Not Received, Incorrect or Lost" A letterA penalty may be imposed for filing with the IRS · Form 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of income

Calameo Irs Instructions For 1099a C

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

· Under an IRS rule change effective in November 16, creditors are no longer expected to issue a 1099C form merely because debt has gone 36 months without a payment If you receive a 1099C for a debt you were not aware was discharged, clarify the status of the debt with the creditor If they are following the old rule, request that they · Form 1099A vs Form 1099C You might receive Form 1099C instead of or in addition to Form 1099A if your lender both foreclosed on the property and canceled any remaining mortgage balance that you owed Forgiven debt reported on Schedule 1099C is unfortunately taxable income You might qualify to exclude it, however, if the total of your debtsForm 1099C is used to report the cancellation of a debt Why do I file 1099C?

Irs 1099 C Form Pdffiller

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

· February 4, Did you you've likely received a surprise in the mail coming tax season the Form 1099C A 1099C reports Cancellation of Debt Income to the IRS According to the IRS, you must include any cancelled amount (any cancelled, forgiven, or discharged amount) in your gross income (which will be taxed), unless you qualify for an exclusion or exception For any5 Ways to Know May 23, Financial Freedom 7 Free Video Platforms for Keeping in Touch with Family May 25, Follow Us Facebook;Form 1099C must be furnished to recipients by February 01, and efiled with the IRS by March 31 each year The 1099C paper filing deadline is March 01, 21 How to fill out Form 1099C?

What Is A C Corporation What You Need To Know About C Corps Gusto

Horizon Software Firetax

· Having a taxable debt of $600 or up canceled by your lender qualifies them to file an IRS 1099C form This form states that the debt has been forgiven, canceled, or never paid back from bankruptcy Filing this form is essential for the debtor in paying taxes unless you qualify as an exempted case · File Form 1099C for each debtor for whom you canceled $600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurredWhat to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans, you'll be sent a Form 1099C by your creditor The

1099 Nec Form Copy C 2 Discount Tax Forms

The Timeshare Tax Trap 1099 C Questions Answered

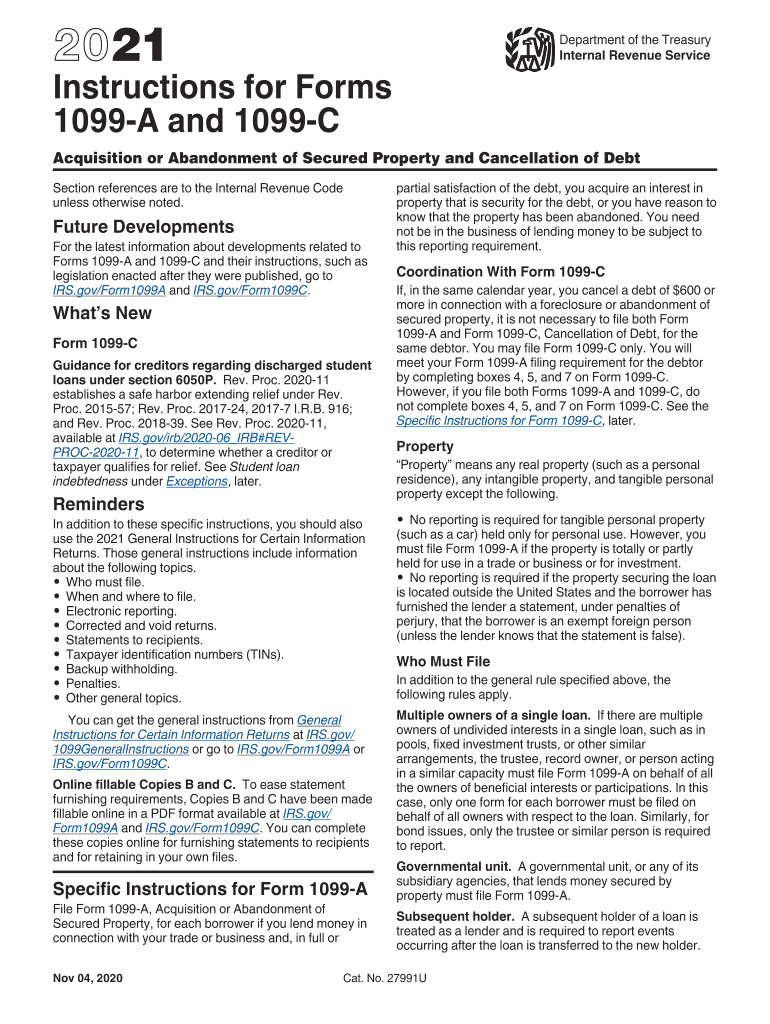

Form 1099C 21 Get Form form1099ccom is not affiliated with IRS form1099ccom is not affiliated with IRS Home;You may file Form 1099C only You will meet your Form 1099A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099C However, if you file both Forms 1099A and 1099C, do not complete boxes 4, 5, and 7 on Form 1099C See the Specific Instructions for Form 1099C, later · Updated May 06, 21 IRS Form 1099C is an informational statement that reports the amount of and details about a debt that was canceled You can expect to receive the form from any lender that has forgiven a balance you owe, no longer holding you liable for repaying it

Don T Fear Irs Form 1099 C Cancellation Of Debt

:max_bytes(150000):strip_icc()/Screenshot39-fb0ecf0139834b37943efafda8ef09b4.png)

Irs Form 1099 C What Is It

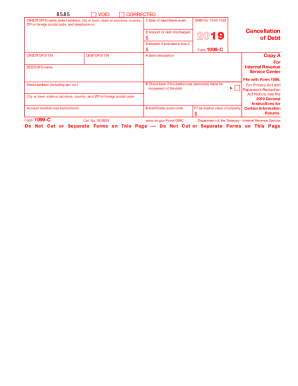

Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only) 19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only) 0919 Form 1099DIVForm 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines that it has not beenDebt forgiveness, tax calculators and figuring out your tax bill;

1099 C Cancellation Of Debt 4 Part 1 Wide Carbonless 0 Forms Pack

1099 Misc Form Fillable Printable Download Free Instructions

Do not file Form 1099C when fraudulent debt is canceled due to identity theft Form 1099C is to be used only for cancellations of debts for which the debtor actually incurred the underlying debt CAUTION!2Instructions for Forms 1099A and 1099C ()

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 C Cancellation Of Debt H R Block

1099 C Public Documents 1099 Pro Wiki

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 C Software To Create Print E File Irs Form 1099 C

Irs Announces Form 1099 C Not Required For Ppp Loan Forgiveness Mcglinchey Stafford Pllc

1099 Misc Form Copy B Recipient Zbp Forms

I Just Got A 1099 C Form For A Debt From 16 Years Ago

1099 Misc Miscellaneous Income Payer Copy C 2up

About Form 1099 C Cancellation Of Debt Plianced Inc

Amazon Com Egp 1099 Misc Payer Or State Copy C Irs Approved Laser Quantity 3000 Forms Recipients 1500 Sheets 3 Cartons Office Products

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

Laser 1099 C Copy C Deluxe Com

pay05 Tax Form Depot

Form 1099 Misc To Report Miscellaneous Income

E File Form 1099 With Your 21 Online Tax Return

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec Tax Forms Discount Tax Forms

Form 1099 Nec Nonemployee Compensation 1099nec

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

Form 1099 Nec Nonemployee Compensation 1099nec

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Irs Form 1099 C Software 79 Print 2 Efile 1099 C Software

What Is Irs Schedule C Business Profit Loss Nerdwallet

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

fed05 Tax Form Depot

Official 1099 Forms At Lower Prices Zbpforms Com

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Irs 1099 C Form Pdffiller

What Are Irs 1099 Forms

What Is An Irs Schedule C Form And What You Need To Know About It

Form Irs 1099 C Fill Online Printable Fillable Blank Pdffiller

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To File Schedule C Form 1040 Bench Accounting

What Is A 1099 C And What To Do About It

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Continuous 1099 C 4 Part Carbonless Deluxe Com

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Debt Collector 1099 C

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

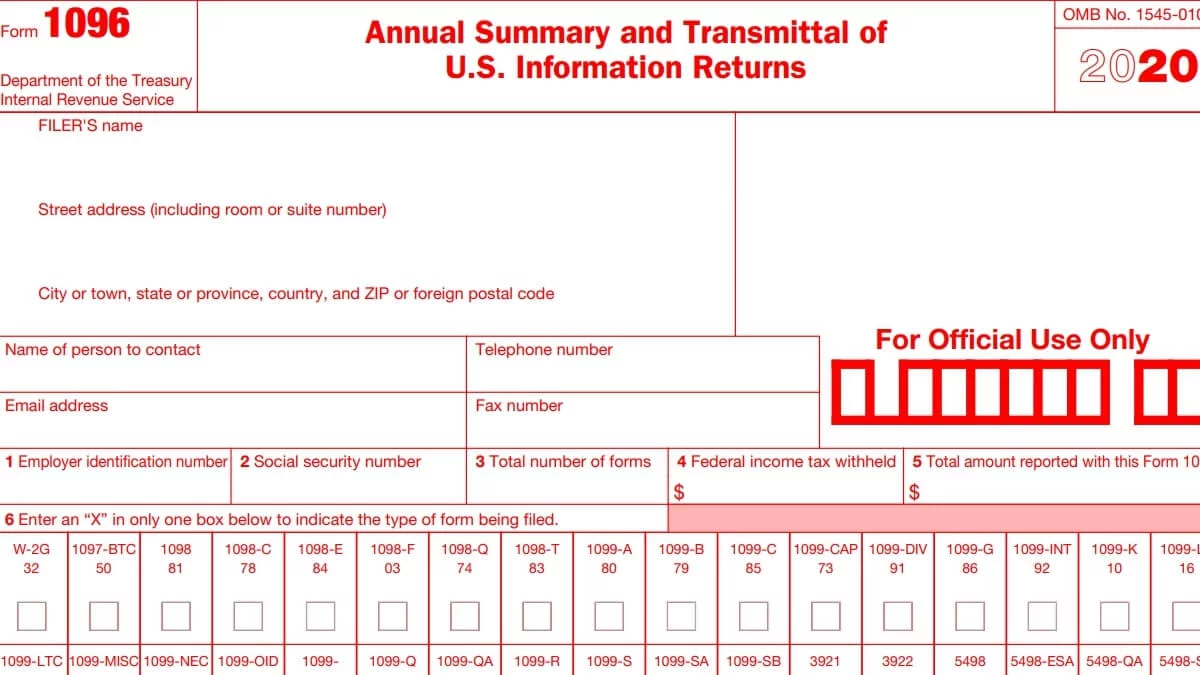

Form 1096

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Index Of Forms

1099 C Carbonless 4 Part W 2taxforms Com

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Form 1099 Nec For Nonemployee Compensation H R Block

What Are Irs 1099 Forms

1099 Form 1099 Forms Taxuni

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

1099 G Tax Form Ides

Cancellation Of Debt Form 1099 C What Is It Do You Need It

1099 C Tax Form Copy A Laser W 2taxforms Com

How A 1099 C Affects Your Taxes Innovative Tax Relief

Irs Courseware Link Learn Taxes

0 件のコメント:

コメントを投稿